E-Invoicing Solutions

INReport

INReport is a centralized RegTech solution that automates regulatory report submission to Regulatory Bodies. It provides the facility to generate reports by integrating the interface with its source system. It can extract data from source systems messages and merge it with required business rules and reporting logic, thus transforming it into the desired file format.

INReport e-Invoice

INReport e-Invoice is a real-time solution that is tailored for the IT backend environment that requires centralization on LHDN e-invoice management for TaxPayer Proof of Income & Proof of Expenses.

- A business entity with Multiple Sources/ERP/Accounting Systems.

- Holdings company would like to have a centralized e-invoicing system across all subsidiaries.

- Foreign brand ERP that does not have e-invoice solutions.

- A legacy system that needs to comply with LHDN e-invoice.

- Looking for an extensive solution that would cover regions upcoming GST or VAT requirements.

INReport e-Invoice complies with real-time transactional requirements on e-invoicing for B2B, B2C & B2G regulatory requirements. Requirement that the Revenue Boards be presented to administer business transactions and to improve the management of countries tax administration.

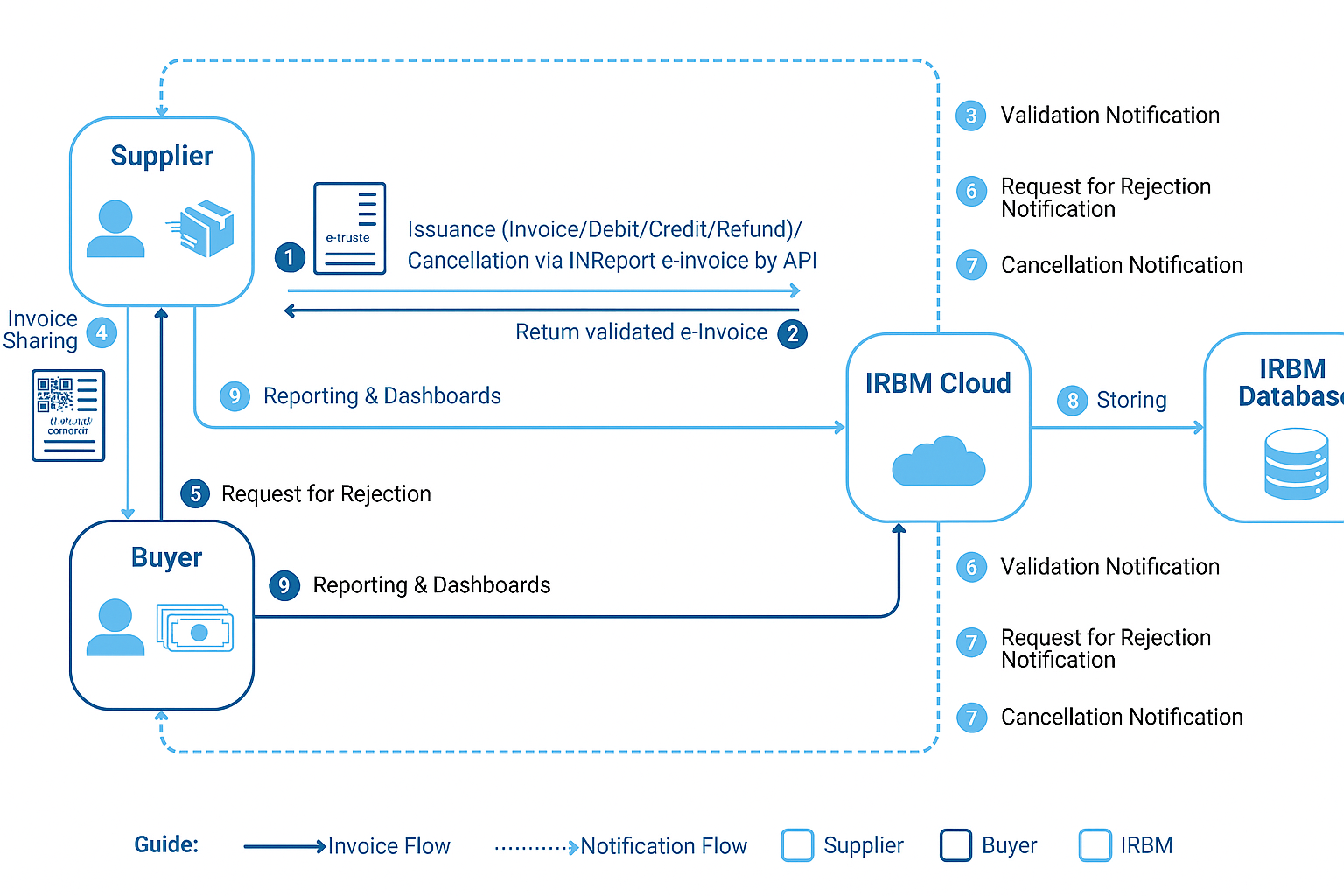

INReport e-Invoice Workflow via API

INReport e-Invoice Features

Compliance

We comply with the e-Invoice model via API for the latest tax regulations and tax reporting requirements. We are dynamic & support future incremental requirements, including the extension to GST or VAT.

One-stop solution by Taxpayer as the Supplier & Taxpayer as the Buyer role

Taxpayer as the Supplier

- E-invoice Pre-Submission (Digital Certificate)

- E-invoice Submission (Invoice/Debit/Credit/Refund)

- E-invoice Validation – UIN & invoice data validation, 72 hours real-time validation with Supplier or Buyer)

- E-invoice Notification

- Sharing of e-invoice (final e-invoice with QR code)

- Rejection and Cancellation (Buyer rejection, Supplier cancellation)

- TIN & UIN Management

- where goods are shipped to a different recipient and/or address

Taxpayer as the Buyer

- Self-invoice

- Cross-border transaction

- Supplier Invoice Storage & Enquiries

- TIN & UIN Management

Source System API Integration

Consolidation

We compile and aggregate into one reporting format:

- Minimize source system enhancement.

Real-time monitoring & alertness

We provide real-time monitoring of invoicing and tax-related activities.

Scalability

We accommodate the growth of businesses or government direction:

- For business: Allowing the addition of new requirements / Tax reporting submissions to comply/submit (GST or VAT)

- For IT: Cloud readiness, scalable

Customized Tax Invoice / Reporting Template

We generate comprehensive and customizable reports that cater to specific business needs and assist in preparing accurate tax filings attached with QR codes.

TIN Management

Centralized Taxpayer Identification Number, provides real-time enquiries.

UIN Management

A centralized module that keeps track of the Unique Identifier Number provided per invoices.

INReport VAT / INReport GST

INReport VAT or INReport GST consolidates Input Tax and Output Tax from various Financial Institutions (FI) across multiple systems, ensuring precise tax declarations. We also prepare tax returns and tax rebate submissions for Financial Institutions, while generating tax invoices, credit notes, and debit notes for our valued Financial Institutions customers.

INReport VAT / INReport GST Features

- Efficiently gather all necessary Data Elements mandated by the VAT Authority.

- Thoroughly document and maintain Audit Trails to facilitate Tax Authority inspections and audits.

- Perform meticulous Tax return reconciliations against consolidated General Ledger entries.

INReport ISS

- INReport ISS is a web base reporting system used by reporting entities to generate Financial Reporting, Compliance Data and Industry Specific Reports.

- ISS reports are generated in pre-formatted excel comply to BNM requirement.

INReport ESS

- INReport ESS manage external assets and liabilities of the bank and generate Cash Balance of Payments(CBOP),Ultimate Beneficial Owner(UBO),Currency Settlement (CS), Inter-Company Account and External Assets and Liabilities (EAL) report

- ESS reports are generated in CSV format comply with CB

INReport DQF

INReport DQF (Data Quality Framework) provide a mechanism framework to identify inaccurate data such as data items exceeded pre-set threshold/validation rules so that reporting entities could provide underlying business reasons/development and details of major contributors which lead to such significant changes in data.

INReport Credit Info

- INReport Credit Info consolidate and aggregate monthly credit data from source system and submit to BNM.

- Credit reports are generated in CSV format to comply to CB

INReport PIDM

- INReport PIDM ensure delivery of seamless, automated and secure system for a complete and accurate submission of Insurance Depository Reporting

- PIDM reports are generated in text file format and comply with guidelines.

INReport FATCA & CRS

- INReport FATCA & CRS generate account and customer data information for foreign taxpayers who hold foreign financial assets with an aggregated value more than the reporting threshold of 50K USD or 250K USD dependent on whether the account type is individual or company.

- FATCA & CRS reports are generated in XML schema base format to comply with official

INReport Recon

- INReport Recon (Reconciliation) automated the reconciliations of the various data transactions from FI to ensure accuracy and ease to reconcile the transactions across multiple platforms. The engine is able to reconcile from 80% to 100% of transactions, allowing more time for users to identify missing transactions or fraud cases.

Analyzing risk and checking/resolving internal controlled issues to improve the rate of accuracy of Reconciliations

INReport SCEL

- INReport SCEL is a single platform for the processing of the counterparty’s risks.

- INReport SCEL lies in its ability to identify and form possible relationships among all the counterparty exposure maintained within the various heterogeneous systems in bank. All exposures in those related counterparties that pose a single risk to banks will be aggregated against a set of rules definable by bank.