Digital Banking Solution

Transforming Financial Services Through Innovation

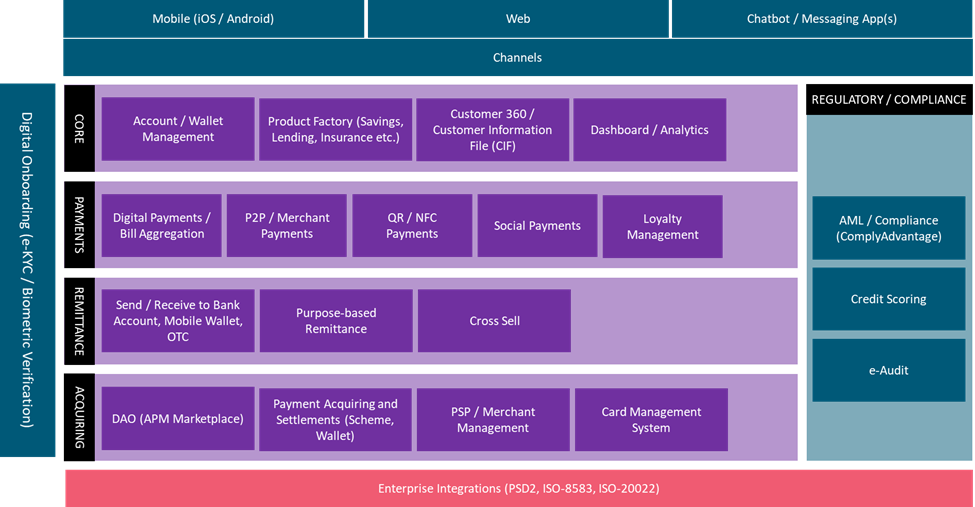

In today’s rapidly evolving financial landscape, a robust Digital Banking Solution is no longer optional—it’s essential. Our comprehensive digital banking platform empowers banks and financial institutions to deliver seamless, secure, and personalized banking experiences across all digital channels.

Key Features

- Omnichannel Access

Enable customers to access banking services through mobile apps, web portals, ATMs, and chatbots—ensuring a consistent experience across devices.

- Core Banking Integration

Smooth integration with existing core banking systems for real-time transaction processing, account management, and regulatory compliance. - Digital Onboarding & KYC

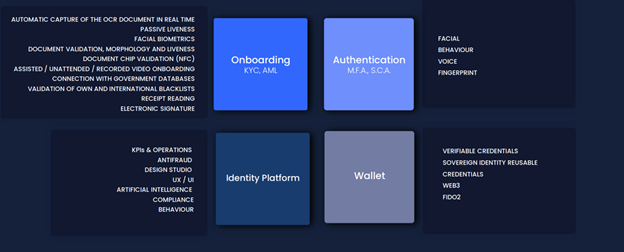

Accelerated digital onboarding with e-KYC, document verification, and biometric authentication for faster account creation and compliance.

- Payments & Transfers

Support for domestic and international transfers, bill payments, peer-to-peer transactions, and QR code payments with high security and speed. - Security & Compliance

Built with enterprise-grade security, multi-factor authentication, fraud detection, and compliance with international standards like GDPR, PSD2, and PCI-DSS. - AI-Powered Personalization

Leverage data and AI to provide tailored financial insights, spending analysis, and product recommendations. - Lending & Credit Services

Offer digital loan applications, automated underwriting, and instant disbursement with integrated risk management. - Admin & Analytics Dashboard

Centralized control panel for managing users, monitoring transactions, generating reports, and tracking KPIs in real time. - Digital Wallet:

CARD WALLET: Empower customers to digitalize their cards for NFC and QR payments in-store, online purchases, P2P transfers, etc. Enable them to store and manage their debit and credit cards, be it from your institution or from other issuers. Issue virtual cards in seconds.

STORED VALUE ACCOUNT WALLET: Keep funds in a closed ecosystem to reduce costs and increase convenience. Expand services to more customers via low-KYC accounts. Stored Value Accounts (SVA) maintain a current balance in the wallet and perform instant transfers in a closed-loop system.

BANK ACCOUNT-BASED WALLET: Link the wallet directly to a person’s bank account. In this scenario, money is moved from one bank account to another. Leverage any available real-time payment infrastructure, such as the SEPA Credit Transfer Scheme in Europe.

Chatbots & Conversational Banking

Take customer experience to the next level through custom AI-powered chatbots for banking, insurance, telcos, and more.

- Reduce customer service costs while boosting digital engagement.

- Implement chatbot interfaces in your existing digital channels.

- Convert leads to customers right within social messaging apps (Viber, Skype, Facebook Messenger).

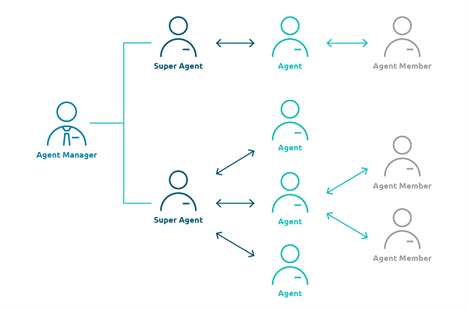

Field Staff/ Agent/ Merchant Management

Ensure the efficient performance of your network operations

- Flexible agent/ merchant hierarchies and roles

- Configurable rules for commission sharing

- Mobile onboarding for agents/ merchants

- Performance Management

Benefits

- Customer-Centric Experience

Enhance customer satisfaction with fast, convenient, and intuitive banking services. - Increased Operational Efficiency

Automate routine processes and reduce operational costs. - Scalable & Modular Architecture

Easily customizable to fit the unique needs of retail, corporate, and neo-banks. - Faster Time to Market

Rapid deployment through cloud-native infrastructure and ready-to-use APIs.

Why Choose Our Solution?

Our digital banking solution is designed with flexibility, security, and scalability at its core. Whether you’re launching a bank, upgrading legacy systems, or expanding digital channels, our platform equips you with the tools to lead in the digital era of finance.